Winter fuel payment scams: How to spot and avoid them

What are winter fuel payment scams?

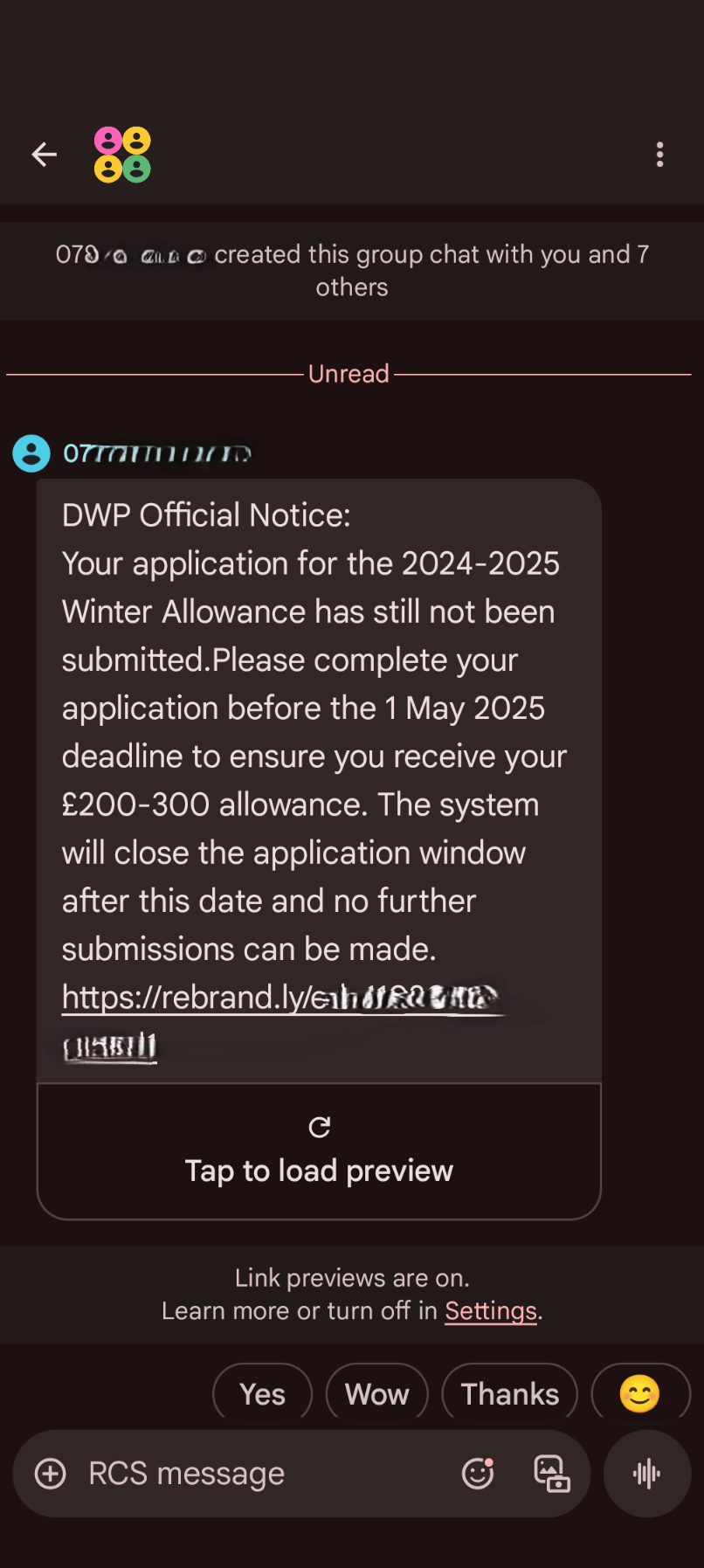

These messages say that people might be able to get money, a new payment, or discounts on their bills. They include a link, asking for details to be updated, and a deadline to make it seem urgent. This is to pressure people into acting quickly without taking time to check.

The aim of this kind of messaging is to capture people’s personal details, so that they can later be used for identity theft or to steal money. They take advantage of the uncertainty and worry that people may have around their bills to gather personal information.

If you receive a text message claiming to be from an official source, offering you money or a discount on your bills, be very suspicious. Don’t click on links in unexpected messages, as they can open malicious software even if you don’t enter information."

How to spot a winter fuel payment scam

Winter fuel payment scams and other energy scams try to look as real as possible – for example, a text message or website designed to look like it’s from the government.

This can make them hard to spot – but there are a few methods you can use to identify a scam.

Spotting a scam text message

The key thing to remember is that the government will never ask you to provide bank details by contacting you via text message. Any text you receive from the government promising financial help with your bills will be a scam and should be ignored, reported then deleted.

Looking at the details of a text message can help you uncover a scam:

Website address

Phone number

Urgency

Email address

Suspicious links

Example of scam text message